- More than 36 million (67%) UK shoppers abandoned online shopping at the checkout last year due to security concerns, lack of payment options, or forgotten card details.

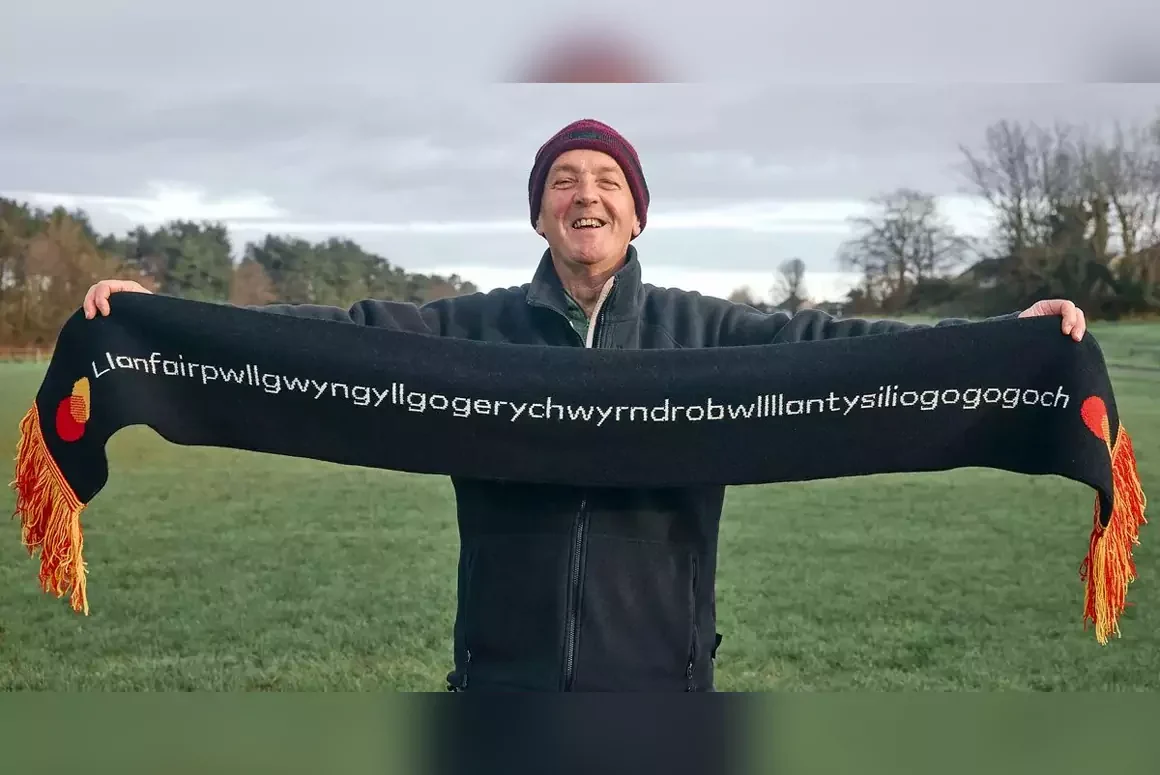

- Mastercard teams up with some of Europe’s longest-named places, including Welsh village Llanfairpwllgwyngyllgogerychwyrndrobwllllantysiliogogogoch, to help them become the first to embrace a new one-click payment technology eliminating the need for data entry when shopping online.

- Click to Pay is the faster, simpler and more secure way to pay online. Backed by the payments industry, it’s part of Mastercard’s pledge to phase out manual card entry online by 2030.

London, February 3, 2025 – Mastercard is teaming up with seven of Europe’s longest-named (“sesquipedalian”) towns, including Llanfairpwllgwyngyllgogerychwyrndrobwllllantysiliogogogoch in Wales, to take the pain out of online shopping, with a payment solution that will do away with data entry once and for all.

Filling in personal details at the checkout, including typing out billing addresses and payment card numbers, is one of the main irritations for consumers in 2025. According to a major new study by Mastercard, nine in ten Brits still type out their full address (93%) and 16-digit card number (95%) when shopping online, despite half (48%) finding it a hassle to do so – particularly in places with unusually long names.

Brits take just under three minutes (2.8) to enter their address and payment details when shopping online, totalling more than three hours over 66 shopping sessions in the average year.

If that feels like a long time, spare a thought for the residents of Llanfairpwllgwyngyllgogerychw-yrndrobwllllantysiliogogogoch. At 58 letters, the tourist hotspot on the island of Anglesey is the longest place name in Europe and welcomes thousands of visitors each year.

It will join six other “sesquipedalian” towns across the continent in becoming a Mastercard Click to Pay Capital, including Brandýs nad Labem-Stará Boleslav in Czechia and Westerhaar-Vriezenveensewijk in the Netherlands.

The Llanfairpwll… community will become one of the first in Europe to try out the timesaving and security-boosting technology. Mastercard is working with a wide range of people in each of the capitals to drive adoption through education and a series of on-the-ground activities.

“Having Europe’s longest name is a badge of honour for our village,” says Llanfairpwllgwyngyllgogerychwyrndrobwllllantysiliogogogoch Councillor Dyfed Wyn Jones, “but having to type it out regularly is a recipe for repetitive strain injury. We’re proud of our heritage but also recognise the value of a good shortcut and the importance of technology that can make our lives easier as well as safer.”

The frustration of having to manually enter details at the checkout may be felt most keenly by those in places with the longest names, but it is a common complaint regardless of where you live, and it comes with an economic cost.

Nine in ten Brits (94%) – more than 50 million people – pulled the plug on online shopping sessions last year when they faced friction or unwelcome surprises at the checkout, and 36 million of these (67%) were for reasons solved by this technology. These hurdles include security concerns, lack of suitable payment options, or just not having the right card to hand.

The payment industry rolled out an innovative solution designed to tackle the problem. Click to Pay is a faster, simpler and more secure way to pay online, that many are likening to the rollout of contactless payments, which revolutionised in-store transactions more than a decade ago. The solution allows shoppers to pay with ‘one click’, without the need to share long card numbers with online retailers.

Simon Forbes, Division President, UK and Ireland, Mastercard, comments:

“Mastercard has been behind many of the great leaps forward in payment technology in the past century, from the creation of the credit card to the introduction of chip-and-pin, and most recently, contactless. In just a few years, it has become second nature to tap your card to pay for something in store. Now it’s time to usher in the era of the one-click online payment.

“Likened to the rollout of contactless payments for in-store transactions, Mastercard’s Click to Pay solution allows shoppers to pay with ‘one click’ without sharing their card details with retailers. The secure process called ‘tokenisation’ replaces the card number with random numbers, or tokens, for each transaction, which are meaningless if stolen. This not only protects consumers from scammers but also protects retailers from cybersecurity and data breach threats.”

Consumers can register their card with Click to Pay on their banking app and look out for the Click to Pay icon at checkout

To see what the future of payments means for some of Europe’s longest named towns, watch the video and to find out more about Click to Pay visit Mastercard’s website here: Click to Pay | Mastercard Europe

Mastercard UK Click to Pay research highlights

Who are the UK’s biggest online shoppers?

- Sheffield is the UK’s busiest online shopping city with consumers completing more than eight buying sessions each month (8.2), followed by Bradford and Southampton (both 6.9).

- Shoppers in Nottingham were the least active online, with just 4.2 trips.

|

Rank |

City |

Average online shopping trips per month |

|

1 |

Sheffield |

8.2 |

|

2 = |

Bradford |

6.9 |

|

2 = |

Southampton |

6.9 |

|

4 |

Newcastle |

6.7 |

|

5 |

Swansea |

6.6 |

|

6 |

Cambridge |

6.4 |

|

7 |

Bristol |

6.2 |

|

8 = |

Leeds |

6.0 |

|

8 = |

Manchester |

6.0 |

|

10 |

Oxford |

5.8 |

Source: Mastercard

Time is money

- The average UK consumer spent over four days researching and buying items online in 2024

- That’s a long time spent entering card, billing and shipping details – even if you don’t live in Llanfairpwllgwyngyllgogerychwyrndrobwllllantysiliogogogoch

Scepticism around saving card details

- 40% only save their details with larger online retailers

- While 59% only save details with frequently used retailers

Privacy concerns

- Meanwhile, 89% are frustrated by requests for unnecessary personal data

- And 52% worry that they’ve shared too much data

Account clutter

- 19% of people do not know how many online accounts, rising to 23% among women

- 53% of Brits have inactive ‘zombie’ accounts, risking password security

Trust in security

- 83% trust payment providers such as Mastercard to secure card details

- While trust levels are also high (81%) in Banks

- However, only 35% trust social media companies and 39% trust foreign retail brands

Convenience is king

- Brits struggle to remember payment details. We remember car licence plates, Wi-Fi passwords and old personal trivia better than 16-digit card numbers

- 19% of 25–34-year-olds abandoned purchases at the checkout due to forgetting card details

- While 18% abandoned purchases after misplacing their card

Feature image: William Parry, Treasurer, Llanfairpwll FC CREDIT: Sam Todd/Mastercard